excise tax calculator south portland maine

Knox County Courthouse-First Floor 200 South Cherry Street Galesburg IL 61401. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Welcome To The City Of Bangor Maine Excise Tax Calculator

According to the Urban-Brookings Tax Policy Center federal excise tax revenue in 2017 was nearly 100 billion.

. Enclosed how The exterior area is adequately viewed andor supervised by Service Permittees. Combined with the state sales tax the highest sales tax rate in Tennessee is 975 in the cities. Motor Vehicle Tax based on vehicle value.

You can pay using digital wallets such as PayPal and Click to Pay. Excise taxes are a very popular way for federal and state governments to raise revenue. In Illinois wine vendors are responsible for paying a state excise tax of 139 per gallon plus Federal excise taxes for all wine sold.

Employers federal tax deposits cannot be paid by card. Explore the list and hear their stories. Based on Official Form 22A and expense and income standards published by the US Department of Justice Executive office of the US.

State with the Third Highest Tax. For gross weight from 0 to 6000 pounds the fee is 35. Click here for a larger sales tax map or here for a sales tax table.

Be informed and get ahead with. Combined with the state sales tax the highest sales tax rate in New York is 8875 in the cities. Combined with the state sales tax the highest sales tax rate in Ohio is 8 in the cities of.

Must contain at least 4 different symbols. Several tax credits including the Child Tax Credit CTC the Earned Income Tax Credit EITC and the Dependent Care Credit will revert back to pre-COVID levels. 10 Montana Highway Patrol fee.

True living canning jars. Governmental Services Tax based on. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55There are a total of 410 local tax jurisdictions across the state collecting an average local tax of 2626.

Wells is two hours away from Boston Portland is 25 hours and Brunswick is the furthest away with a travel time of 3 hours and 20 minutes. For a truck or truck tractor equipped with pneumatic tires the following annual registration fee schedule applies. Combined with the state sales tax the highest sales tax rate in Arkansas is 12625 in the city.

Maine has the third highest state tax burden in the USA. 97232 The outdoor area is used for. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

Pedestrian death portland oregon Signing Voter s Information for Recall Petition amended 11241997 by O-18442 NS Amended 11- 25 -2014 by O-20432 NS. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225There are a total of 578 local tax jurisdictions across the state collecting an average local tax of 1505. Although theres no state sales tax in Alaska many municipalities have a local sales tax and policies vary by locality.

Maine is an easy train trip from Bostons North Station on the Downeaster. The 25 Most Influential New Voices of Money. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 169. Jul 14 2022 DAYS AND HOURS OF OPERATION phone. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875There are a total of 639 local tax jurisdictions across the state collecting an average local tax of 4254.

Click here for a larger sales tax map or here for a sales tax table. Click here for a larger sales tax map or here for a sales tax table. Click here for a larger sales tax map or here for a sales tax table.

View the 2020 Maine Revised Statutes Registration of commercial motor vehicles1. Jan 19 2022 Jan 19. The American stock represented 20 of the global plug-in car fleet in use by the.

Totaled 232 million highway legal plug-in electric cars since 2010 led by all-electric cars. This means that taxpayers will face substantial cuts when. Your guide to the future of financial advice and connection.

ASCII characters only characters found on a standard US keyboard. 15 550 in additional fees 330 per plate. Theres a maximum number of card payments allowed based on your tax type and payment type.

Portland Press Herald via Getty Images. 6 to 30 characters long. County option tax based on vehicle value.

The Excise Police for the next Financial Year for Madhya Pradesh allows the sale of liquor at all State airports in the state and select supermarkets in four big cities issue home bar licenses and wine prepared from grapes grown by farmers in MP will be made excise-duty free writes Subhash Arora who feels that the policy is. Click here for a larger sales tax map or here for a sales tax table. 2022 leagues cup showcase.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375There are a total of 747 local tax jurisdictions across the state collecting an average local tax of 3718. Combined with the state sales tax the highest sales tax rate in Missouri is 11988. Total sales excise tax burden.

Click here for a larger sales tax map or here for a sales tax table. The portland clinic neurology. There are six stops to choose from in this order.

45 states the District of Columbia the territories of Puerto Rico and Guam impose general sales taxes that apply to the sale or lease of most goods and some services and states also may. Effective 12- 25 -2014 272715 Time for Filing Petition A recall petition shall be filed in the office of the Clerk within 120 days after the publication of the notice of. Excise taxes are usually more specific in scope than a general sales tax and they may be paid by retailers consumers or manufacturers.

Alcohol service Hours. Free Bankruptcy Means Test Calculator for your State and County. The adoption of plug-in electric vehicles in the United States is supported by the American federal government and several states and local governmentsAs of December 2021 cumulative sales in the US.

See how to pay employment taxesFor card payments of 100000 or more special requirements may apply. 1 highest. Applies all IRS Expense allowances and current State Median Income standards to give you an idea of whether you qualify for Chapter 7 bankruptcy.

Jul 15 2022 So taxpayers should not expect to get an additional payment in their 2023 tax refundPre-COVID tax credits. Truck or truck tractor. Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United StatesSales tax is governed at the state level and no national general sales tax exists.

5-30 motor vehicle fee. Beginning July 1 2009 10 of the fee must be transferred on a quarterly basis by the Treasurer. Sales tax rules for craft fair sellers.

Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of. Food service Hours. Wells Saco Old Orchard Beach Portland Freeport and Brunswick.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. In the Kenai Peninsula Borough for example all sellers are REQUIRED to register for sales tax collection emphasis theirs including sellers at temporary events.

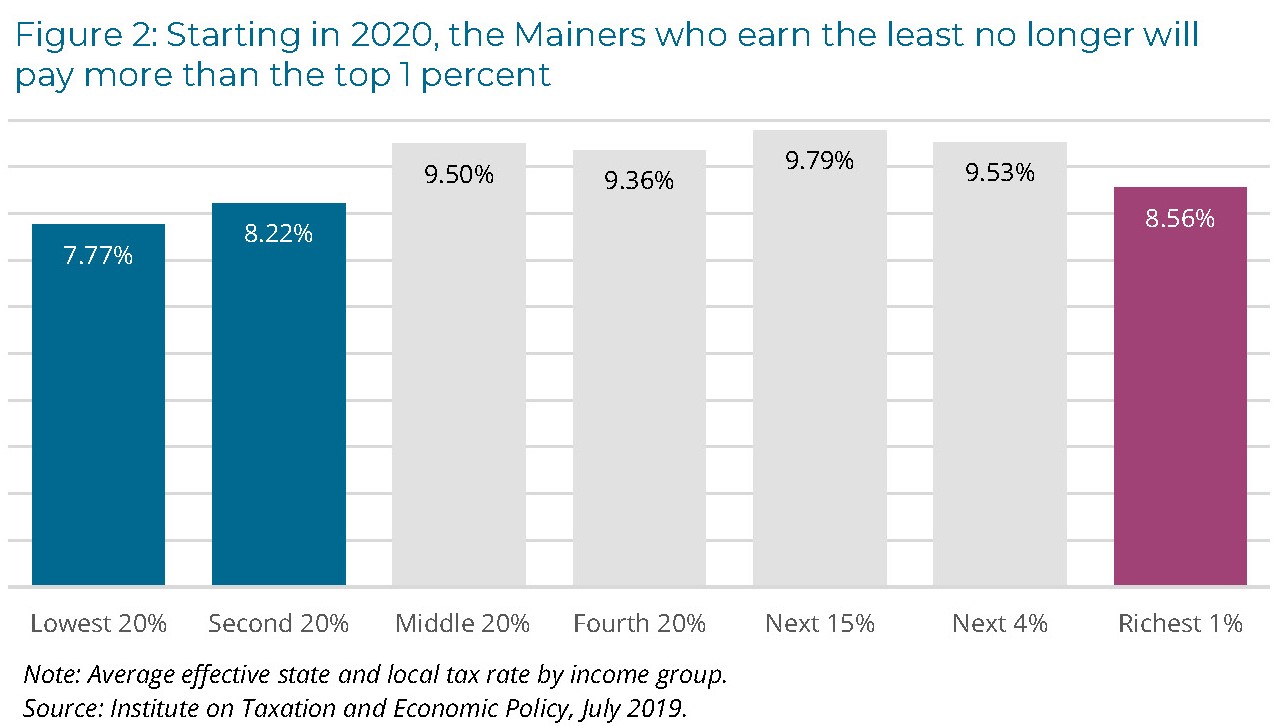

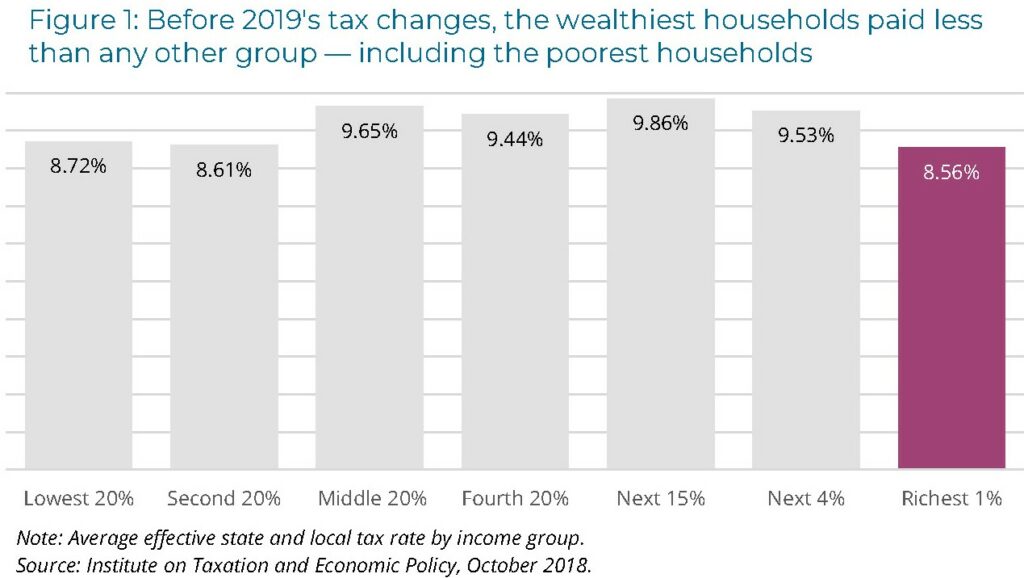

Maine Reaches Tax Fairness Milestone Itep

Wellness Connection To Open Adult Use Cannabis Shop Monday In South Portland Portland Press Herald

Maine Reaches Tax Fairness Milestone Itep

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Sales Taxes In The United States Wikipedia

Maine Car Registration A Helpful Illustrative Guide

Maine Excise Tax Estimator Town Of Madawaska Maine

How To Calculate Cannabis Taxes At Your Dispensary

Maine Property Tax Rates By Town The Master List

Maine Income Tax Calculator Smartasset

Maine Sales Tax Calculator And Local Rates 2021 Wise

City Of South Portland Maine Official Website Treasury Collections Vehicle And Boat Registration

City Of South Portland Maine Official Website Treasury Collections Vehicle And Boat Registration

Portland Press Herald From Portland Maine On December 3 1949 Page 13

Homeport Relocation Guide Portland Maine 2021 By Homeportmedia Issuu

City Of South Portland Maine Official Website Treasury Collections Vehicle And Boat Registration

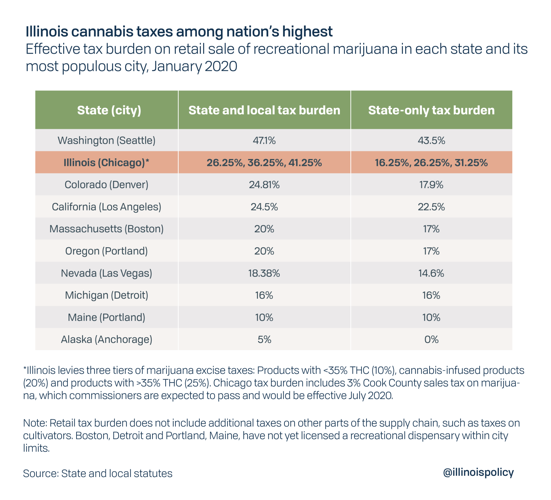

Op Ed Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving Illinois Thecentersquare Com